Lighting for Profits Episodes

Lighting for Profits is your #1 source for all things landscape lighting. Whether you are looking to learn about lighting design, lighting installation, or just need helpful tips on how to start or grow your landscape lighting business, you are in the right place.

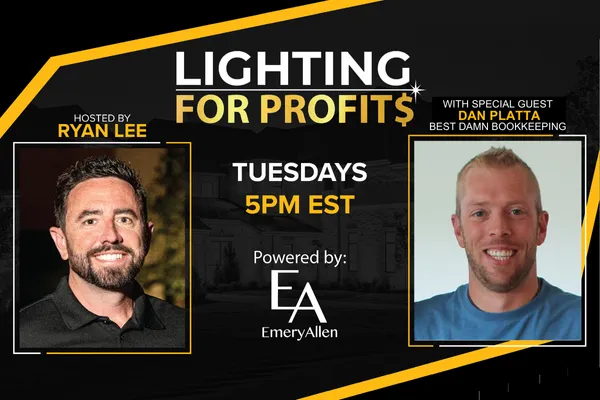

Dan Platta - Guide to Mixing Work and Play

Lighting for Profits - Episode 162

This week on the show we welcome Dan Platta, a fun-loving, beer-drinking business enthusiast with a passion for balancing the serious world of business with a laid-back, enjoyable lifestyle. Always ready to dive into the latest industry trends, yet equally excited to kick back with a cold one after a productive day. This business nerd thrives on mixing strategy with good times, proving that success and enjoyment can go hand in hand.

Watch the episode

Episode Transcript

Ryan Lee shares tips on how to start and grow a successful landscape lighting business

Welcome to lighting for profits.

All light, all light. All light.

Powered by Emery Allen.

Get rid of your excuses.

Your number one source for all things landscape lighting.

That's where the magic can happen. You can really scale a business.

We really had to show up for each other from lighting design, install, sales, and marketing. You're a scaredy cat salesman, Kurt. We discussed everything you need to know to start and grow a successful landscape lighting business.

What do you think a hippo has to do with your business, Ryan? Usually it's some weird childhood thing, some bully kiddeh. I think the key factor here is trust.

Here is your host, Ryan Lee.

A light. A lot a light. Whoo. Whoo.

This is an important episode if you're looking to start or grow your landscape lighting business

That's my cheer for Minnesota. We've got, I don't know if you guys know this, but just, we just found out we're the number one landscape lighting show in twin Cities. The twin Cities area, apparently Minnesota. I don't know if Twin Cities is a city. I think it's just an area region. But, Excited for the show today, guys. we've got the one, the only, mister Dan Plata. He is the, best damn bookkeeper. No, really, he is like, that's the name of his company. So, he really is the best damn bookkeeper. And, I don't want to scare you off too quickly here, but we are going to talk some numbers. We're going to talk some business. And, ah, what's cool about Dan is, he has a really good way of just bringing it down to earth. And you don't get bored. You're not going to get bored. You're not. You're going to actually walk away with actionable items that you can do in your business to, move the needle forward. And, this is going to be a super important episode if you're looking to start or grow your landscape lighting business. So we're here to educate and motivate, to help you dominate. Really, really love doing this show, you guys. so many good things have come of this, relationships, just in the network of mine and stuff like that. I've gotten to know so many people in the community, and, it's just a great show. So stick around. In just a few minutes, we're going to have Mister Dan Platt on to talk numbers and business. And, really excited, guys, because I don't know, like, if you join landscape lighting secrets today, I don't know if there's enough time to be at our secret summit, but just to kind of throw that out there we're meeting in a couple weeks here in park City, Utah, and, it's going to be amazing. I'm super excited for that. That's kind of my, my next big thing that we're doing as part of that session, we're going to launch landscape lighting secrets 2.0. And, that is going to change the landscape lighting industry forever. I'm just so excited to announce that. So, stay tuned. We'll be keeping you posted here on the socials and on the podcast and everything, but a, lot of, lot of exciting things in the work. So, been doing a lot of, strategy sessions, and if you haven't booked yours, do it now. Go to landscape lightingsecrets. com. just click start. Now follow the process. You can actually book a call with me and, we'll get on there and, help you really devise a plan to make sure that you're going to make it through this, this, whatever this is right now, potentially down economy. Okay. I like playing, like, free, unlicensed music. Might be licensed. I don't know. No one's ever heard this music. But, thank you, Emery Allen. You guys know this. Nothing hurts a quality landscape lighting install quite like flickering bulbs, a yellow fringe around the perimeter of the beam spread, or bulbs that burn off out after a few on and off cycles. Don't jeopardize your customers experience by using a budget bulb. If you want to go out of your way to provide a world class customer experience, choose Emery Allen. At the end of the day, it's what's on the inside that counts. So make sure to take advantage of Emery Allen's world class customer service and get 10% off your first order. All you got to do is mention that you heard about Emery Allen here on lighting for profits. And write down this. Email tom gallen. com. just email tomgryallen. com and he will hook you up with that discounted contractor price just mentioned. you heard about them here on lighting for profits. They got great looking lamps. I mean, that single source led is super crystal clear. It just makes the project look so good. So check them out.

Give people a call to action when you promote your business

All right, guys, so in just again, a couple minutes, we're going to have Dan Platt on the best damn bookkeeper. And, before we have him on, I've been doing all these strategy sessions. I think it's because I've been promoting myself. Can you. Can you imagine what that would be like if you told the world about yourself and actually gave them a call? To action. I've been doing this over the last couple months on the podcast, and I invite you guys as you're listening. Like, if you feel prompted, like, reach out, get on a call with me. And it's crazy because, like, I thought people knew that, right? But when you just invite people, so when you guys are doing marketing, like, give them a call to action, like, what do you want them to do? Book a call, schedule an appointment, call for a free demo, whatever it is, right. You'll be surprised at how much that affects your business. So, been doing quite a few of these, and I've been loving them. And I've found a few common trends where, like, all the calls seem to go the same direction.

JC: Landscape lighting companies are facing challenges because of changing economy

Because we get into, like, what your challenges are and what. Where.

Where.

Where you're struggling and the ruts that you're stuck in and how can we help you? Right. And, it seems like the economy has shifted a little bit, and there's some challenge presented and almost all these similar issues everyone's having in. Around the, around the Us. I'm hearing things, like, well, we just can't command the pricing that we used to. Like, now it's just a lot harder. We're having to negotiate more. We're having to lower our prices. we can't get clients to spend as much as we used to. So we might. Maybe we could have sold someone 30 lights. Now it's only 25 or 20. Or it used to be 50 lights, and now it's only 40. Right. They now have a lower average ticket. So just those first two alone, they're lowering their price, and they're lowering their average per ticket. They're. They're starting to see some financial problems. Right. Then we're. We're having. We're hearing, oh, well, we can't get people to move forward. Well, we got to think about it. We got to get multiple bids. Right? Or they say, I don't know. I just don't have the leads coming in that used to come in a year or two ago. Right. And here's the. Here's the reality. Like, these challenges are not new. This is like the challenge of every business of all time. In fact, I experienced these same challenges when I was running my landscape lighting business. And it. Of course, there's times that are easier and there's times that are more difficult. We just happen to be entering one of those kind of valleys and leaving one of those peaks. Right. But it's kind of crazy because inside landscape lighting secrets, we have the solution to these challenges. And I know this because I was in, I was in these valleys, and I had to figure out how to get to the next peak, right? And so inside our inside landscape, lighting secrets, it's basically built on three pillars. The first one is raise your prices. And we not just tell you, like, what to do, but how to do this effectively by giving you the proper scripts and the strategies and the templates and everything you need in order to command that top tier price. The second is closing more deals on the spot. Almost everybody that I've talked to is not charging enough money, okay? They're, they're nothing. They literally just don't know what to charge, and they're not charging enough. And then when they're given an opportunity, they're not closing the deal, and they're going back and they're emailing and they're taking time to follow up and doing all this stuff. And, and even if, even if the only thing that closing a deal on the spot helped you do is get back more time, because you weren't following up with people for 6810, 12 hours a week just in follow up. I mean, what would that do for you? What would that do? If you now had 6810, 12 hours a week? What would you do at that time? Right? How could you grow your business? How could you be more strategic? And then finally, the third pillar is high quality leads. You can't charge a premium price, and you can't close deals on the spot if you're in front of the wrong person. So what are you doing to generate high quality leads from people who are ready to pull the trigger? Okay, no one wants leads. No one wants to just go waste time giving proposals and talking lights. Well, that may not be true. Some of you might, because you've been doing it for years. so maybe you do enjoy it. Like, I don't like to waste time, okay? I don't want to go talk lighting and talk shop with someone if they're not going to move forward with me. So I want to make sure I'm dialing in my client avatar, and I'm only targeting the people who are ready to move forward with me today, right? So those are the three pillars. Raise your prices, close more deals on the spot, and get high quality leads. Now, it's easy to say that, right? And just make a blanket statement, like, everybody needs that. But in reality, a lot of people are not ready for this, because if you look at your brand, if you look at your customer journey sequence, if you look at the products that you use, like, can you really command these high prices? What's up, JC?

Take a step back and go through the client journey process

Good to see on here. I mean, really, what I want you guys to do is take a step back, okay? We all have bias. We all think we're the best. Well, I do, but we all think we're the best at, like, design or install or sells or marketing or, or business or whatever, right? We all, we all have this bias that we're better than our competition. But, like, take a step back and go through the client journey process as if you weren't the owner and you didn't have this pride in your brand and everything else. Like, is your brand really as good as you think it is? Is your client journey as good as you think it is? Like, are you answering the phone call within two rings? Like, it rings once and you pick up because you're like, oh, we're the best. Well, how many calls did you miss today? Right? And how long does it take for you to get back to people? And are you really giving the client what they want? Are you closing the deal on the spot? Are you giving them a price? Are you making them wait a 24 hours or 24 days? Some of you to email a proposal? So you need to go and audit. This is like a self audit of your entire company. And it starts with your brand. It starts with just even a logo. Okay? And your logo is not your brand, but it's the identity of it. It's the start of it. And if it doesn't communicate the red carpet, white glove experience that you're promising to your clients, then there's a disconnect there and you're fighting an uphill battle, and you're trying to charge a premium price and do all this stuff. And it's like, well, you have a weak brand, so you're, you should probably start with that first. Right? If your, if your brand is on point, and then you start and you really audit that client journey, and you're answering the phone and you're professional and you're pre qualifying. Okay? And there's a lot. There's a lot that goes into pre qualifying. I could literally do, like, an eight hour day just on pre qualifying. But let's say you've got that all nailed down, then. Then maybe you're worthy of that premium price. Then you're worthy of commanding that deal on the spot. Right? these are things that you guys have to look at, right? And, I'll be honest, some of you don't even have to do that. It's just up here in your mindset. If you just convince yourself that you're worthy of it, then you're worthy of it.

Raising your price is key for everybody. Cause it allows you to fund growth of your business

And one question I like to ask myself when I'm going into an opportunity for someone to make a, buying decision with me is like, what is the consequence of them not moving forward? Okay? And I take this, like, very, very personal. Like, if someone reaches out to me and we get on a strategy session, and then you're like, yeah, you know what? I really like this. I think I want to, I think I want to look learning. I, want to, like, tell me about landscape lighting secrets. And I don't, and I don't do my best job, okay, really, of showing you the value and how this is going to change your life. And I show up and I'm tired, and, I bring emotional baggage to the call or whatever it is, and I don't go all in on you and you decide, you know what? Let me wait in a few months. Let me wait until, I have more money or let me wait till it's a better time, then I've done a disservice to you, right? And that is the consequence of you not moving forward with me is that you're going to have a crappy life. You're going to struggle even harder than you were before. You're going to continue to get the same results because you're going to, you're not changing anything. You're going to keep doing the same thing over and over and over. You're going to experience insanity. Right? So it's up to me as a professional to guide you along the way. And it's up to you guys, it's up to you as a professional to be there for your client, show up for them 100% every single time, and convince them to move forward with you, because what is the consequence of them not moving forward with you today? Okay? If they don't get lighting, what's going to happen? If they get lighting was from someone else, what's going to happen? What are you saving them from? What are you helping them? And if you get crystal clear on that, all this becomes very, very easy. Right now, we make it easier because we give you the scripts, we give you the strategies, we give you the support calls, all that stuff. But I just want to remind you, these are the three pillars that matter right now, okay? And we're gonna be talking numbers with Dan. We're gonna probably talk recruiting. Who knows? We're gonna talk about bucks and beer. I don't know. We're gonna talk about crazy stuff. But raising your price is gonna be key for everybody. Cause it allows you to fund the growth of your business, closing deals on the spot. It's gonna also add money to your bank account, and it's gonna free up time for you to do what the things that you want and need to in your business. And finally, getting those high quality leads is kind of the magic pill. And when you get those, life becomes very easy because people aren't asking you. Well, you know, What about your price here and there? And can you do it for this? They're like, when can you start? That's the key. So that's my rant.

Dan Plata is a business coach who helps entrepreneurs improve their books

I think it's time to get the best damn bookkeeper on here. Let me know if you guys are ready, if you're here live. And, Let's find some buttons. Get him on. There he is, mister.

Beer. You. Somebody say beer?

I think it's beer 17 right now.

It is beer 17. So I got instead, I got water with electrolytes in it.

Is that for me? Thank you.

No, but it's almost gone. Wow.

I didn't know. I mean, are you going to be okay? Are we going to be able to, like, talk shop or.

We'll see. We'll see if I fall apart or not.

Yeah.

My kids are home. My kids are home. I was like, Danny, get me a bush light, and then should run one up if I get too parched.

Well, yeah, I don't want you to be in too hydrated. It could. It's actually a dangerous thing.

No, no.

Well, I'm excited to have you on, Dan.

Water with electrolytes. That's what bush light is, right? That's all?

Yeah.

Water with salt.

Just depends on how you read the label. Yeah, I met Dan, several years ago at clip a con, and, I was in the back of the room. I was like, okay, there's this guy, Dan Plata, speaking. And then I'm after him. So I'm like, I'll listen to him. And then, it was like, 10:00 a.m. and then he's up there and he cracks a beer, and I'm like, holy cow, what's going on? And I was like, man, it was nine.

I think it was nine. I don't think I'd wait till ten.

That seems late for you.

Okay, that's double digits. I think that was nine.

So I was like, well, clearly this guy's important. And, I need to go meet him. So that's where we began our relationship. Thanks for coming on the show.

Thanks for having me. It's always fun hanging out. And you're right. Raise your prices.

Yeah, yeah. And Dan actually knows what he's talking about. I'm just a, business coach. Dan actually is legit. He's seen. He's seen your books. You need to raise your prices.

I don't know of legit, illegit, whatever. But I do have a unique lens that I get to see everybody else's business, given the nature of mine. And so I see what works and I see what doesn't work. Kind of a nice little. Nice little position.

Yeah. Right. It's weird how it works that if you have more money in business, you're able to be more successful. It's just this weird phenomenon that I came across years ago.

It's a handy tool. It's a handy tool to have in your business.

The number one thing that I think business owners hate is finance

Well, you know, the number one thing that I think business owners hate is finance.

I would agree with that. That's good and bad for me. It's good and bad for me because it's very likely then when we do a demo, that they're like, yeah, man, just do it. Just do it. Whatever. Whatever you got to do, just do it. But it does cause people to drag their feet in reaching out sometimes. largely because I don't think they understand. They don't understand what they're looking at. And so it's a little intimidating sometimes. and I think they're. They tend to be biased by what they think bookkeeping is. I damn near if, it wasn't on social media, I think I would have been in a fistfight with a guy a couple months ago because he was dead certain that bookkeeping is not a thing that should add value to your business. It's something some old overweight lady should be doing from a desk in an old accounting clerk's office, and it's just pushing buttons. And that's a. That should have nothing to do with helping you run your business. And I was like, man, that sounds like some shitty bookkeeping to me. But that. But he was sure that bookkeeping should not be helping you organize your data and help you make decisions. He was absolutely sure of it. That's not what bookkeeping is. I was like, man, I think, you're living, like, a couple centuries ago. Yeah, you gotta. Gotta level up. He didn't like, he didn't like what I had to say, well, he's, I.

Mean, that sounds hardcore, but to be honest, I feel like I know a lot of people, they probably wouldn't, like, debate it that hard, but they, if I'm being honest, they probably think like that. Like, oh, yeah, you know, bookkeeping, I mean, if I have time, I'll do it. Like, I don't know, I pay this bookkeeper like a few hundred bucks a month, but I don't even know what they do. I mean, I do get an email with like a p and l questions.

Once a month, once every other month.

Know your numbers, especially when you're newer in business

So let's talk about that, because honestly, like, I mean, you hear all the time, and especially when you're newer in business, like, know your numbers. Know your numbers. It actually becomes annoying. And you're like, you know your numbers? That's, that's, that was like my good comeback.

Your mom knows her numbers. Yeah, I know your mom's number. I'll have to be a good, that's.

A, that's a good one. Yeah, write that down.

Everybody write that one down. That's a good one.

I told you there'd be gold nuggets. We got one.

That's it. Quote that.

Home service businesses should always be tracking their cost of goods sold

But let's maybe talk about what are, let's talk to the, I mean, dude, even if you've been in business 15 years, chances are you don't know your numbers. It's just a blanket statement. There's some heroes out there that know their stuff when they get started, whatever. But it's, it's a really hard thing to do because as visionaries, we don't want to deal with that shit. We just want to like, change the world and do crazy stuff and whatever. So what are some basic numbers, like maybe the top three, four, five, whatever it is that we really should know on a weekly, monthly basis and like, get our eyes on and then be able to evaluate what that means.

I think the biggest one in any home service business is that you should always be tracking your cost of goods sold or cost of the sale. It should cost you about 50% of the revenue to get the job done. And thats specific to lighting. Other industries might be a little bit higher, a little bit lower, but if its much higher than that, no matter what the industry, theres not much money left for you to grow the business. And I think when I say that, it's also very important that if you are out there installing the stuff or cleaning the thing or whatever it is that you're up to, that your cost is represented in there, right it's the full cost of production. It's the cost of the labor. It's the cost of the supplies and materials that are getting installed. It's the cost of the tools on the truck to go install the thing. It's the cost of fuel to get out there, the merchant processing to charge that credit card. Anything where you can point to misses Jones's job and say, for us to do that job and get paid for it, it. Here's what it took. All of that is part of that cost, that sale, and that should be around 50% or lower. if it's too low, you're probably not paying your employees enough, and you're probably getting crap labor and having a hard time keeping people. If it's too high, there's no money left for you to invest in growing the business and for you to make any money as the owner. so, in home service, it tends to shake out about there. And if you can just do one thing like, that is the thing.

Start there. I like it.

Get that dialed in. and it's part of the reason I've seen more landscape lighting companies doing this, too, Ryan, is it's part of the reason a lot of people are moving towards pay per performance style pay structures rather than hourly. When you pay technicians hourly, you create this win lose scenario where the employee wins when you lose. Right. Their paycheck gets bigger when they cost you more money. And when you win, it's because you really priced a job high. And it. And it doesn't take long for them to do it. Now they lose because their paycheck is lower. And so when you're paying somebody hourly, there's. You're always on the opposite side of the table. You win and lose at different times. When you pay somebody some sort of performance based pay, where they get a percentage of the job, and some. There's a whole bunch of different ways to do it. Now, you win together and you lose together. But I think that's super important. When you write somebody a big ass paycheck, that's paper performance, you don't. Your brain doesn't go into, oh, crap, that cost me a lot of money. Your brain immediately goes as a business owner, holy smokes, they made us a lot of money. And you say, us not. They made me. They made us. Right. Like, holy ghost, I got a $2,000 paycheck this week. How cool is that? We want our people to be successful. We want them to get huge paychecks. And now when they get to share in the upside. And the more money they make, the more money the business makes to reinvest in growing and to pay us a little bit and to go hire other awesome co workers for them. Like, that's a whole lot more fun to run than, oh, crap, I just wrote that guy a $2,000 paycheck because he had a bunch of overtime in, and he didn't even get that job done. Anyway, that sucks. Those are not paychecks to write. So I think part of the, the beauty of, that paper performance is it also aligns with keep it, with hitting your 50% cost to get sold. You can use a percentage system that, like, protects that 50%, and you get to win together, and that's just a, more predictable and a hell of a lot more fun to run that business.

I love that. Like you said, you can protect it, and it's like, no, you're part of this percentage. So that percentage can go up or down the dot, the dollar can go up or down, but the percentage stays the same.

Yep, yep.

Ryan: I think it's important to balance recruiting and hiring

Well, I. Last week, we had Shawn day on, so we talked all about recruiting. Let's, let's, you know, and we did, we did talk about abcs. Always be cruden. But, the thing, the thing is, and I, like, I love that you brought this up. A lot of people complain, and they go, oh, I don't want to pay a guy that much. And I'm like, I've always celebrated, like, dude, my goal, and I don't know how I'm going to do this yet, but I want to pay someone a million dollars a year one day, because no one's ever paid me a million dollars a year. So it's like, would that be cool? And if I can afford to do that, then I'm probably doing pretty well, right?

I was gonna say, ryan, I'm totally happy to help you make your dreams. If you want to pay me a million dollars a year. I I'm down.

Okay. I'm in this. Yeah. Turn to a job interview. Yeah, that's my goal. I really, I know I can do it. I just don't know how yet. but, like, I think it's awesome, like, when, when you can pay someone as much money as possible, because that means you're winning, and a lot of people do the opposite, and they're like, well, man, this guy, he's just starting out, wants $25 an hour, and I'm like, well, what if you just paid someone 30 an hour and, like, got someone better, you know, and you can afford, and whether you're talking paper for performance, whatever, you can afford a higher rate for a higher qualified person if they're better and they're more efficient and they require less management and all this stuff. So I think it's important that you balance this conversation with recruiting and leadership and all this stuff.

Yep. There's, there's one thing I've found. Hell, right before you and I jumped on here, I just did a group interview with like 15 people. and it's Sean and I just did a webinar together, actually. And that was my one episode to do on the webinar. The other, it was a five parter. The other four he did. But the, the one I did was on group interviews. I'm interviewing and I, and everybody hates when I do this. On the interview, I'm like, here's the, here's the shtick, guys. I don't have a job for you right now. I'm, I'm interviewing you now to make sure that when I'm calling somebody, I know who the first person is that I'm going to call. I don't have a job for you now. I probably won't for six months. but recruiting and hiring are different. I don't want to wait till I need somebody to go find them. I want to have my top ten to 15 people, and I need to know who I'm going to call first on that. Listen, because if you have awesome employees, and I'm looking at this from the finance perspective, when you have awesome employees and they're like the best of the best and you pay them well, however it is, a, you can charge a lot more, but b, your business is so much more fun to run. When you have awesome employees that show up every day, that I have a really positive attitude, that like solving problems and so many people, and, and I'm, I used to do this, too. I actually made this error in this business, already once. and I corrected it, but I did the thing that I said not to do, which is so many of us hire the first good enough person that comes through. Instead of getting hundreds of applicants, we'll get 50 or 100 applicants. That sounds like a lot, but you're not going to get somebody that's amazing for your business if you just bring in 20 to 100 people. Even I'm, I'm hiring for my bookkeeping account manager job. I still have two people I want to bring on first, which is probably why it's six months before I can even hire any of these people, but I want ten in my list, and I'm kind of down to two from my last round about six months ago, which is good. We've been growing like crazy, so I've brought a lot of those people on. I've got two more that I want to bring on, but that's not enough to have on reserve, so I got to, like, fill back up my reserves. I bet I'm getting 500 applicants.

Wow.

And. And I'm going to filter that down to, like, the top ten or 20. But even when I have those top ten or 20, I'm going to call the best person first. And, man, it just, like, it just always guarantees that you are only hiring ridiculously awesome employees. And it's surprising to me how you would think that nobody would be available come six months from now. But either their circumstances are changing or they still are at the same place that they wanted to leave six months ago, and they just haven't found the right fit. And they're like, thank God you called, because I'm totally ready to go. I haven't. I've had some where the timing, we had to massage a little bit, but of all the people I've. Everybody that I asked to come work for me, even, like, six months after I interviewed them, has, at some point came and worked for me.

I know. And the cool thing about that strategy is, like, that all star, if you didn't do that, they might take another job right now because they're like, well, I just did that. And then when you go to hire, you know, recruit them, hire them six months later, they're like, I just started this new opportunity. I don't love it, but I'm gonna give it two years or whatever. So you're telling people, like, we've got opportunities all the time here, so they might call you and be like, you know what? I'm going to hold out because I know in six months there's going to be an opportunity there, and those all stars are going to stick around. Like, they're. They're also playing the game. They're also looking, before they quit their job, to find another job.

And I told them all that. I was like, hey, I don't have a job for you. I fully expect that if you need a job right now, you're going to go get it. That doesn't mean I'm not going to call you in six months. You might take a job, and it sucks. Good thing we're gonna be in touch. Like, that's the whole point. This is recruiting. This isn't hiring. and, man, it's like, when you get that right, your business grows so much faster. I. This was super, super, obvious to me. After a while, after screwing it up for long enough, it became really obvious, when we ran maid service businesses, I could look back at, like, a decade of that. And if there was a time our business wasn't growing, it was never because of sales and marketing. It was always because of employees. They. We turn them over, we wouldn't have good ones. We'd lose clients. but every business is that way. When you have great employees, your business grows so much faster. When you have shitty employees, it doesn't matter how good you are at sales and m marketing. You just spend your time running in circles, chasing them around. Tom G. In the house. Emery. Emery Allen, everybody. Let's go.

Business owners hate finance and people, according to a poll

Well, I started off by saying the number one thing that business owners hate is finance. And I. This was a poll. It's kind of like a political poll. If you ask, you know, at least two people.

Yeah. who's enough?

But then. Then the number two thing is people, like, business owners hate finance and people. Yet here we are in business. The only thing that matters is, like, business is fine. It's financing m people. So we're crazy people. You have to be nuts to start your own business because you just do stuff that you don't like to do all day long.

That's probably why. That's. That is us as small business owners is we. That's our job is to do stuff we don't like to do. So we just embrace it.

Yeah. It's like whoever is the most successful just figures out how to embrace it the most. Like, you win.

Brian. Dank in the house. What's going on, Brian?

So be dank. He's gonna be hanging out in Utah with us here in a couple weeks.

I'm, gonna be hanging out virtually. I need to get. I need to get. I have it. I have it blocked off, but I need to get my specific time from you. Pacific time. Specific?

No, we're not on Pacific. We're on mountain.

Yes.

Thank you.

If your margin is too high, that might be a problem

so, cake. Cost of goods sold is the thing that they need to use. I know. I noticed you mentioned, like, tools. So, like, a lot of people are, like, blah. You know, when you brag to your friends at, like, conferences and stuff, you're like, hey, man, what's your, What's your margin? Like, 65. Oh, really? Yeah. Mine's only 50. Like, you know, that's kind of like the measuring stick, isn't it? so I like that you said if it's too high, that might be a problem. Like, maybe. Maybe you should be investing in other areas. But I think a lot of people aren't putting a lot of stuff in there that they don't know is happening in real life, like tools and fuel and things that actually cost money and.

Or they're the one doing the install and they're not taking a paycheck, so their labor is free, so they have no wages, so their margin is just fake anyway.

Yeah, I love fake margins.

I see that a lot. I want fake margins.

What? When I do fake margins, I'm up at like 90.

Yeah, you should at least be at 90. If you got fake margins and you don't have to pay anybody for them.

Those are the best.

You can crush it.

You know, I, we do like a, spreadsheet called the daily, overhead. And, like, I. I used to forget about this. So I tell people about the things that I used to do wrong. Like, don't forget about taxes. Like, they have to go somewhere. Probably not in cost of goods sold. I'm no Dan Plata, but I'm pretty.

Which taxes. There's like a billion types of tax, so maybe. And they all go somewhere different. They're pain in the butt.

So, I just put them in one area called taxes.

Taxes.

but then there's, like, equipment replacement costs, like when just because you have a drill today or a ladder, like, at some point you're going to have to have a budget to replace that. And if you don't plan for those things, like, it happens. And then you're like, you buy it because you need it, and then you're like, damn, where'd all the money go? And it's like, well, it went somewhere, and it's because you didn't budget for it.

So maybe talk to us about creating budgets and how we can use them

So maybe talk to us about creating budgets and how we can use that. Not as a restrictor, because most people hear budgets and like, mm mm. Don't put me on budget, Dan. I'm a business owner.

Tell me what to do.

Yeah, buy a hot tub if I want to buy a hot tub. But how can we use a budget to empower us and not restrict us?

So I tend to look at budgets. They get, I think people get too anal about them and, like, look at them monthly. To me, it's. It's like a long term percentage thing. Even when we, like, do the books for a landscape lighting company. We're. We're stretching their data out. We look at it monthly, quarterly, year to date, trailing twelve. So we look at it over different periods of time. And, yeah, there's going to be a month where you got to buy a new trencher. but that's not every month. And so I don't want to get hung up on, like, well, that month we can't buy it because we didn't meet the budget. Well, then you wouldn't ever buy it, right?

Yeah.

So we kind of got to look at it over time. I like to. On the supplies and material stuff for cost of goods sold there, there tends to be three different things that we spend money on. the biggest one is supplies and materials. The fixtures that we're putting in, the. The, wires, the breakers, the transformers, all the stuff that gets put out at the job site. In general, that should be around 30% of the cost of the job. might depend on exactly what you're using. Whatever is assuming you're using Emory Allen bulbs, of course. the tools and equipment, though, like, you're gonna need a ladder, you're gonna need some wrenches, you're gonna need other stuff. And I. And I delineate between supplies and materials is stuff that, like, gets left out at a job. It gets installed, like, it gets consumed. tools and equipment go back on the truck and go to the next job, and the next job and the next job. And so the supplies and materials will tend to be pretty predictable per job. The tools and equipment. Like you said, you might have a ladder you've been using for two years, but now you want to upgrade to the one with the leveling feet, or we had in our business, we. Our window cleaning business, I think we had twelve trucks outside. Somebody came and stole all ladders one night.

Good find.

$11,000 worth of ladders we had to replace.

You might have something like that happen. And so where does that come? Theft is a weird one because it is technically, like, tax deductible. So we always kind of set it off to the side as an other expense. It's not something that one we don't, like, typically plan on. but it still needs to hit the books. Right.

If you're in, like, if you're in like, Detroit or LA, I think you.

Yeah, then maybe. Yeah, yeah. but.

But even, like, should there be like. Like, we had a. Our team, like, just trampled these bushes one time and of course they were imported from Malaysia or something.

And it was half a percent. Half a percent to damages and repairs.

Okay. Yeah, we got it. We got it. We got to have a number in there.

Yep. And then, like, tools and equipment varies by industry, but it's usually around one to 2%. But when you. When it's the month where you buy the stuff, it's 10% sometimes. And hopefully that only happens, like, once or maybe twice a year. And so it averages out. And one of the. One of the interesting things that I found is we can, we can use a percentage. It's always a little skewed for the dude that's just starting out, because if he's rigging up his first truck and you're rigging up your fourth, and you both need some ladders and a trencher thing and, some tools for this. Like, the dollar amount is going to be the same for both of you, but his percentage is sure to be a lot higher. Way higher, because spread across five grand of revenue for the one job that he got this month, and yours is spread across 100,000 of revenue. Right. and so there's some, like, nuances and stuff like that, but over time, it should spread itself out. and so I don't, I don't get too hung up in the month to month of the budget, but I do like to look at it over different time periods so that I don't, I don't, I don't want to knee jerk to, like, monthly data and be like, oh, shit, we got to change everything we missed this month. I. If it's near term performance, I like to look at three months worth of data, and I pretty much always look at the trailing twelve. Like, if the year went from last July through this June, how did we do? What does that twelve months tell us? And so nuances of when we bought those supplies or when the truck broke down and we had to repair it. Like, those months sucked. But it needs to balance out across the entire year, not just looking at this month versus the last month.

Yeah.

Thing.

No, that's huge.

Dave says there are certain sweet spots when scaling your business

Well said. I, I also like that you brought up the fact that, like, depending on where you're at in business, like, a lot of this stuff is gonna. Is gonna mean different things. And so this is why I'm so passionate about helping so many people is like, if you. If you decide to stay small and you don't want to grow a team or whatever, like, that's fine, but, like, it's like an unfair advantage when you get to a certain size because these percentages, like, just come into your favor and, like, it's easier to make money and you get momentum and, like, there's so many people doing it the hard way. And I'm like, that works. Like, if you're just trying to fill in a few years or something like that. But if you really want to build something that's easier, like, you have to get to a certain size, and then if you go a little bit bigger, then all of a sudden you're back to like, oh, crap, I hate my life again. Until you get to that next phase. But, like, there is these happy freaking spots where, like, these bigger businesses have it so much easier than the small guys. And that's where you get time, freedom, and that's where you get, like, that's where you get joy. That's where you're happy instead of just, like, working every single day.

Yep. Yeah, there's definitely sweet spots. I, I present on that a lot, and I call it the purgatories of scaling, is I don't focus on the sweet spots because everybody can do that. Everybody can run that business. It's the times when things suck where you. Where you look in the mirror and you're like, do I even deserve to be a business owner? Like, we all have that super negative thought process at times of, like, what am I even doing here? I'm terrible at this. I'm working twice as hard to not making any money. all my employees suck. Blah, blah, blah, blah. We've all. Everybody that's ever started hiring employees and scaling their business has been there. and that's super normal. And again, like, I have a weird lens because I don't just see it in my own businesses. I see it in everybody's business. And if I saw your books, I had one guy that was going to work with us, and he's like, hey, I think I'm going to fly you out here so you can really get boots on the ground and see what we got going on. I was like, Dave, like, just give me access to your quickbooks. I'll be able to tell you more about what's happening in your business looking at your quickbooks for ten minutes than I ever would walking around your shop. I can be there for a week, and I can literally tell you more. I will tell you stuff that you didn't even know was happening in your business by. By looking at your books. I just. I have a unique lens of just being able to see what's working and what's not working.

Sorry, Dave. I know you signed a confidentiality agreement, but now everyone knows who it was.

Yeah, Dave.

Oh, I got. I don't know which way to go with this letheme.

Marketing is the first investment we make when we're scaling a business

Okay, so we've got a, we've got our percentages, we've got our cost of goods sold, and then there's other stuff, overhead and whatnot. A lot of people right now are struggling with this, so I want to see. Normally, I just do softball questions that I know you already know the answer to, but I don't know if you know the answer to this one. So here we go.

I'll make it up. Make one up.

Prove the best damn bookkeeper right now. So someone is listening right now, and they're. They listen to me, and they say, okay, well, Ryan said I have to pay more money for advertising right now to generate more leads, because the $0 that I'm spending right now is not generating enough. But I don't have, like, I don't. There's a percentage is not 15% if. Let's just say they had a, budget built, and the budget for advertising is 3% right now, and I'm telling them they need to do 15. How are they going to make up at least some of that percentage? How can they get more. More into that?

I mean, it's just an investment, right? The marketing is the first investment we make when we're scaling a business. So, like, when. When we do bookkeeping, that's the first line below gross profit. And it's. That it's up there for a reason, is once you have gross profit, once you do a job and you pay all the costs to do the job, the 50% of money that is, some of it should go to you, but a lot of it needs to go back to growing the business. And growing a business is expensive. The two most important things by far are employees and customers. You can talk about tools and equipment and trucks, but you can. You can do a job with the shittiest stuff, but you can't do a job with the shittiest people, whether it's the customer or the employee. So I would say marketing tends to be the first thing we should spend money on. The, Now, if you don't have a great employee to send out to that customer, I'd say back up for a second. Go, like, really dial in your recruiting. But I. Marketing is the first thing you should be spending money on. And now I'm fine. I think, like, five to ten is kind of normal if you're just kind of going, but not pushing that hard. If I'm looking at a client's books and you spend a 2020 5% on marketing, I'm not like, oh, my God, you're so bad at marketing, my reaction is, hell, yeah, like, you're going for it. understand that when you're investing heavily, there's not a lot of profit, right. Because you're growing really fast. The faster you grow, the less money you make. that's, that's the nature of the beast. The faster you're growing, the less profit there's going to be until you get to one of those sweet spots like Ryan was talking about. M and so I'm all about putting a bunch of money into marketing and growing fast. That's, that's fun. That's what it's all about. so to me, it's, it's less about the percentage you're spending on the marketing. It's more about, is it working? What's the acquisition cost? How many leads are you getting from it? How many, how are you good at sales? Are you converting those into clients? What's your conversion rate? what's the average job size? And I'm going to talk about this in Utah, so I'm not going to give it. Well, you're going to be in Utah. I'm going to bed here with the same wall behind me.

Marketing is an investment, right? It has to generate a return

but how do we calculate these things so we know which sources are working and not working? Because marketing is in, it's an investment, right? It has to generate a return. But it's probably the number one thing in our business that's a gamble. You can, and I have dropped 80 grand on something that did not work.

It is a gamble, right, which investing is. You can go put money. If you, if you're scared to market and you don't want to bet on yourself, go put it in the stock market. They can lose your money, too. Right? You can, you can go invest in a bunch of stocks that'll go to zero. you might make money, you might lose money. Marketing is no different besides the fact that you have control of it, right? Unlike going and putting your money in the stock market where it's like, here you go, hopefully this thing goes up and you have no say, you have no control. You probably don't even have very good info on what the hell is going on over there. Like, you have pretty good info on what's going on in your marketing. So it's your personal stock market. but you got to be measuring the shit out of it. Make sure you know what's working, what's not working, so you can do more what is and less of what isn't.

Yeah, well said. I think what you just said was absolutely gold. And I don't know that people are going to understand it to the level of like intelligence that it was because so many people start businesses and underestimate how much effort physically, financially, emotionally, all those drivers that need to go into it. And it's like, I mean, it sounded so simple. It's like, well, yeah, it's an investment. You have to do marketing. Well, then why is nobody doing it? And it's. And I think it's because they tried one thing and it didn't work. They tried a $10,000, maybe not quite an $80,000, you know, expense, but they spent money on direct mail, they spent money in a magazine, a Facebook ad, Google Ad, 510 15. They're in $20,000. And it didn't work. And so obviously advertising sucks. And now I'm just not gonna do it. And it's like, man, that's not how advertising and marketing works. Like, now you know what doesn't work? You're what? You're like 3ft from gold. You're just a little bit further. Another 5000 and you would have landed 420 thousand dollars projects. And now you're making money. And it's frustrating for me because I'm like, I can't like generate leads for you. That's not who I am. Like, there's strategy, but you got to be consistent. You've got to set that. That's why I like what you're talking earlier too, with the macro. Look at it is like if you just look at one month or even one quarter, you're like, damn, we're screwed. But like, no, you look at it over a year, 2345 years, and you're like, man, look at that. The first three quarters we lost money. But then every single time after that we made money. And most people are not in a position financially to lose money, even 30 days because they don't have a rich uncle investing into their business. They don't have Warren Buffett. They don't have this kind of money. To lose money, like our money's real.

Money, you got to get yourself a sugar mama. Ooh, yeah.

Is that a. Ah. How do we do that?

I don't know. That's a. I'm just always spending Marty's money.

Okay.

She makes all the money. I spent it.

But she should open a, she should do a course like sugar mama secrets or something.

I,

This is my second time scaling a bookkeeping business

Even in this bookkeeping business, we are about a year into best damn bookkeeping. We started last September. and I kind of have a cheat code because a, this is my second time scaling a bookkeeping business, but b, I get to watch all of our clients grow their businesses. So I see what works, what doesn't work. we are 140 clients, which for a recurring service business to add like 140 clients in about a year is bonkers. Growth. I think we're at about a 500 and it's tricky because we have some revenue doing this and some that's stable. But I'll say we're at about a $500,000 a year pace right now. So we're a year in on a recurring service business, $500,000 pace, which is more than I thought we could even do, like scale. but I've made $0 in a year. I started, I shouldn't say zero. I started taking a paycheck because I want to reflect the cost of me doing work. I don't have it as high as it should be for me being the salesperson and the marketing person, whatever. but it's super important to me to like reflect some cost for me to run the business. and all of that, like zero profit in twelve months is totally by design. it takes me three months to train up an account manager to do a good job for all you guys. Like, it's not my, my company isn't really good bookkeeping or average bookkeeping. It's best damn bookkeeping for a reason. Like, I am, I am so ridiculously steadfast about having, like I talked about our recruiting. Like, we're just never going to have a shitty employee. It's not happening. I'm not putting it up with, with it. I don't want our clients to have to put up with it. I don't want their coworkers to have to put up with it. So by design, I'm investing a lot in that and a lot in like marketing to go to trade shows and make content and make a podcast and do all that stuff. but growth is expensive. Could I have made a hell of a lot more profit this year? Hell yeah. If I would have stayed at a, $200,000 pace or $300, $300,000 pace. Those are nice little sweet spots. I would probably be doing more of the day to day stuff, not just pushing on growth, we probably have 60 clients instead of 140. Totally could be doing that. I would have more money in my pocket. But that wasn't the goal. The goal was, let's grow this thing so that more people can get what we have. And to grow it, I need to put some money into it. Like, it's a huge investment. So by design, we gotta go.

Love it.

Is an investment a sacrifice if you want to grow your business

So was average damn bookkeeping. com taken?

Yeah, I was taken. So I couldn't do that one.

Yeah, I could totally see you leading with that one.

Average. Pretty, pretty darn good bookkeeping.

Oh, man, this is so good. I. If people would just understand that, like, at some, somewhere, there has to be an investment. Like, if you want to grow, it's just gonna. Is an investment a sacrifice, and you got to be consistent. It takes time. If you're willing to allocate those dollars, they're gonna come back. and unfortunately, most are not gonna listen to that. Most are just gonna keep stand small. And then, then it's like, when you, when you have, like, two leads a month, and then you go to one lead a month, like, you're, you're just gonna go out of business. Like, it's just not gonna work.

So, yeah, it's a slippery slope. I like to, And I'll probably say this again when I'm, when I'm talking about, stuff for the event in Utah here, but one of my favorite clients that we work with for like, two years, grew like crazy, had a pressure washing business. Went from a few hundred thousand to a little over a million to, like, two and a half, 3 million in the course of, like, three years. and I love to say, like, how much money you think that guy's making? Like, 3 million a year. and everybody's like, you think, you think he's making bank? And every year, I'm like, no. Like, lost four, $400,000 last year. growth is expensive. Like, say, same thing as I did. There was, there was some marketing, in our window cleaning business. Literally spent 80 grand on it. And, I mean, I don't, I can't, I'd be embarrassed to say what the acquisition cost was on it. So I'm going to do the math. But it was like, we got ten to 20 clients with an average job size, like, $300. I mean, it was, it was horrendous. but that's marketing. That was an investment, and we, we put too much in without doing enough due diligence on it. and so I just like to make that point because you can grow really fast and push, push, push, and that's cool. But, like, how long can you stay solvent for? How long can you stay cash flow positive? Do you have enough money to do that? And so it's this constant balance and there's no right or wrong answer. There's going to be times in your life where being a little more conservative and staying small might make more sense, and there's going to be times in your life where you're like, risk on, baby, let's grow this thing. Let's go for it. so there's no right or wrong answer. You can have a fine life either way. It tends to be, though, if you're here listening to this, if you're a small business owner already, you probably got into it thinking, let's go. Like, I'm going to do this thing. I got it. What it takes. Yeah, I know there's going to be some headwinds, but I'm gonna listen to Ryan and Dan and see if I can pick up some tidbits to help me push through it. Right. So if you're here, you're probably already made up your mind that you want to push and grow. And so all I'm saying is be ready to invest. Don't. Don't spend money stupidly, right? Don't blow it. Don't put it into shitty gambles. invest and calculate and invest and calculate.

Hot tubs.

Grow the business.

Yeah. A lot of people buying hot tubs. You know, you make that. You make that.

There's an inflatable one for, like, 400, $500 on Amazon.

That's what you guys should do. Do you have, like, an affiliate link? We could sell inflatable hot tubs and save people thousands.

Hot tub. Hey, makes sense to me. Makes sense to me.

Do you have a financial gift, uh, card giveaway question for Brian Dank

Do you have a financial gift, card giveaway question you could come up with in a couple minutes for Brian Dank? He's like the champion of gift card giveaways.

He wants to give away a gift card for his service, or he's trying to give away a gift card for mine.

Yeah, I think that's what it is. He's trying to give away gift cards? No, I give them away. I give away 50, dollars gift card just for, whoever answers the question first has to be correct and has to be whatever answer you think is correct, not what they think is correct. So, weird rules. I didn't come prepared with a question, and I don't have time to think of one. But if you have time to think of one right now, then you think of one.

Oh, let me ask. Let me throw this one out there because you mentioned taxes earlier.

Wait, is this, it. Hold on, hold on. I have to play music first.

Oh, okay, let's go for it.

Yeah, it's, like, official. Wait. Oh, yeah.

Whoever answers this next question correctly will win a $50 gift card giveaway

Gift card giveaway. All right, it's everyone's favorite time, especially if your name is Brian Dank, to win $50 and, by myself. Dan, I'm not going to ask you to step up to this. Brian, I'm not going to ask you to pay for your own gift card giveaway. But whoever answers this next question by Dan Plata first in the chat, based on what we see, not what you see, and whatever our answer, Dan thinks is correct, will win a $50 gift card giveaway.

Cool.

Go ahead.

My turn.

Yeah.

Riddle me this: Where do you categorize your federal income tax payment

All right, let's just say you're going to pay your income taxes out of the business. Where is the correct spot to categorize your federal income tax payment? Whether it's estimated or actual, after the fact? Where do you categorize your federal income tax payment? In your books.

That is so good.

Riddle me that, boys and girls.

Yeah, go ahead. Give them the answer. I dare you.

Give me.

Of course, I. You know, I don't. I'm restricted from playing the game myself, so I won't answer, but only because of the rules. Yeah.

Don't give in to Google guessing game. I'm surprised nobody's gotten googled

All right.

So weird to win a $50 gift card from yourself.

Yeah, I think I did once, and I just gave it away because no one knew the answer. I mean, we can't just let money go, like, we have to spend it somewhere. It's in the budget.

Somebody could be out there googling this right now. I'm surprised nobody's gotten, you know, gotten googled.

To get Google and AI. I mean, it's not always right. And again, they. It has to be your version of right. This is one.

Yeah, I was just saying it's probably the Google might give them the answer for a different type of business.

Exactly. So don't. Don't give in. M don't give in and be like, well, I could see why you're saying no. It's like, whatever is in your head right now is the right answer.

I've got it. I know what the right answer is.

Okay, so ask the question again, and then we're moving on.

Where is the right was?

Let's say you're paying federal income taxes out of the business

I'm a frame, it up again. Let's say you're paying your federal income taxes out of the business. Where's the right place to categorize your federal income tax payment, whether it's an estimated income tax payment or, like, the actual end of the year? Here's the. Here's what I owe the IR's. Where do you categorize that in your fancy dancy quickbooks or whatever?

Is there. Is there, like, four options we could give them?

Or. Because.

Yeah, I could probably do a multiple choice.

This is definitely like an advanced, podcast session. Normally, I'm like, the acronym RGB stands for, what? You know, and, like, they'll just. It's pretty easy. So this is very difficult, Dan. I. I'm kind of impressed, but,

verbino landscape says k one. That's how you know how much you owe. And.

Oh, wait, definitely.

It's definitely going down the right path. So there's a number on there that you, Let's do. We're gonna do multiple choice. Let's see here. I gotta.

Yeah. Make sure the orders. Right. You don't want to give this off. by the way, this was just for, robino landscapes. I was just behind on the, sound effects. Yeah. I'm like, man. Oh, again, Dan, can you.

Yeah, it's not. It's not a right answer the second time, but sometimes you got to double down. Sometimes you got to double down.

are you going to give us the options?

I'm just. I'm writing down. I'm trying to do.

Oh, you're trying to think of another one?

Yeah.

I mean, you could put anything, like. Cuz no one's gonna know this. So you could just put, like, a made up thing. You could like the back of the transformer panel. Like.

Yeah, I'm trying to. I'm trying to make one up, but then you keep talking to me and it's getting. It's really. I'm a man, so I can't multitask.

So I like this. I'm gonna keep doing it. That's why I couldn't even come up with a question is because I'm like, I have to talk and think at the same time.

It's impossible to talk and think.

Okay, I'm going to keep going then.

All right, I got it.

Oh, okay, go.

Okay. four options.

Where do you categorize your personal owner income tax payment from the business

Again, the question is, where do you categorize your personal owner income tax payment from the business? Is it under payroll taxes? Is it under taxes and licenses? Is it under owner distributions? Or is it under other expenses?

Oh, man, I love the other one because I put a lot in other.

Right. That's why. That's why I put it in there. I was like, I really like that one. Good catch all. Yeah.

It's like, what is in 486,000 in other. I love that one.

Yeah.

One of my very vague categories of all time buying.

We could have been buying some other stuff.

Yeah. What'd you buy? Well, obviously some other. Yeah.

Yeah.

All right.

We got other.

Other income. Is that correct?

He's assuming he's other income. He's assuming he gets money back from the IR's. That's a.

Sorry, Jeff. Still love you.

Rubino says owner disp.

I don't even remember that as being one of the options. What is a disp? Is it like a lispennesse?

That's. It's got to be stopped. Tom, I'm assuming Robino was going with what Tom Garber said, and Rubino is on his phone. He's out there. He's on his phone.

We have to account for spell check.

Yep.

Auto.

Yep. Tom. Tom went with, owner distribution. And that would be the right answer.

Hey.

Oh, it is an owner distribution. Now, here's. Here's a little fun fact tidbit for you. so, like, when our business owes income taxes, it's not actually our businesses liability. It's ours. Our. Unless you're a c corp, the business doesn't actually pay taxes. Even if it's an s corp, all the earnings flow through to the owners via the k one that Rabino landscapes was talking about. And the owners all pay their taxes individually. But it's super customary that if, like, you own your business, you're going to pay the taxes out of the business, because the tax. The. The business is the thing that created the tax liability for you. Jeff says Molly would have gotten it. Molly would have gotten it. Yeah, he's right. Molly would.

Let's give it to Molly. yeah, I think. Sorry, Tom. Sorry, Rubino, but,

But so your federal income tax payment is not an expense. Even though it's taxes, it's not a business expense. It's really a personal expense. So it goes down as an owner distribution. Over the last few years here, your state income taxes are now federally tax deductible, in some cases, depending on states and depending on how you're set up as a business. I'm not tax expert, so I'm not going to pretend to know all of it. But in those cases, we do put state income taxes, and this is probably what Jeff was thinking. We do put state income taxes under other expenses now, because it is technically tax deductible on your federal return.

Right.

Taxes are stupid.

That just.

I do bookkeeping and not, taxes.

Listen, this. It's too late in the day to even continue what you just said. because I didn't listen to any of it, and partially. And. But thank you, though, for making everyone feel good. How you, like, went, like, oh, you probably thought like this. They. Listen, these guys can handle it. They gave the wrong answer. They didn't win. But I do think we should give Robino landscapes the victory here. I mean, he. That's up to you, really. But I think he had good intention.

You need to make sure you pay your taxes, Scott says

He meant to learn how to spell, but he didn't. And he was.

Honestly, he's definitely on his phone.

Yeah. Okay. So I think. I don't know. We may have your info, but send us. Just send me a DM and, make sure we have your, proper address and stuff. And we're gonna mail it out, tomorrow. Your $50 gift card. So, thanks for playing, everyone. That was. That was the trickiest one, most difficult one we've ever had.

You think so? Yeah, leave it to me.

Yeah, that was. And then the stuff that you said after, I was like, what?

So I blacked out.

Seriously, I was thinking, like, wait, is it because I was hitting buttons? I don't know. But you really got to pay attention when it comes to this stuff. So,

Scott. Scott, he wants to know, should I be learning this stuff? it's okay for you to be aware of, but. But we'll handle it. You just need to make sure you pay your taxes, Scotty. We'll handle making sure it goes to the right spot. You just gotta pay them. We don't pay them for people.

Scotty: How much do we really need to know about numbers

So here's. I think that's actually a great question by Scotty, is, how, like, how I wanna kinda do this all in one. Like, how much do we, as visionaries, as leaders, CEO's, do we really need to know this stuff? And, like, I know you've got a program, so talk about your program. How do we get started with it? When do we look at these numbers and just all those types of things that. Because, like, I don't. You know. You read the book. Who not how. I was setting you up. Who not how.

Who not how.

Thank you.

Sorry. Who not a long time. It's been a long time.

That wasn't even planned. I just planned it. Like, it just came out. So you read the book. Who not how.

Who not how.

And you're like, well, no, I'll just find a who. And my Dan is my Dan. My who is Dan?

My Dan is who.

My dad is who you are my dad. You guys don't reach out to him. He's my m Dan. But, like, you're a lot of people's who. Because in my opinion, the last paragraph that you just said a few minutes ago, I think you should just black out and then let you handle that and then let the visionaries run it. maybe I'm preaching bad stuff, but how much should someone know? And then how much should the bookkeeper and the CFO and the CPA do?

I mean, I think. I think the business owner has to know enough about how to read the data. Right? and we. We do that for our clients. When we send a month end report, we actually record a video for it now. and send them a video along with it. So it's not like a. Ah, hey, Ryan, here's your p and l. Good luck. We send them a. Hey, Ryan. Here's what's happening. Here's what's working. Here's what's not working. This is going up. This is going down. You're saving money over here. You spent it over here. and so I think they need to understand what that all means. Right? And you said it earlier, Whether we like it or not, we're playing a math game. Like, if you are running a business, I don't care if you're a numbers person or not. Every single decision you make is a math decision. You signed up to play a math game. You don't, and you should not be dicking around in your quickbooks. You don't need to be a quickbooks expert. You don't need to be a bookkeeper. You don't need to know why this thing goes on your balance sheet and this thing goes on your profit and loss. But you do need to know how to make decisions about when to buy this, when to invest in that. and probably the most important decision you make is who do you trust to do a good job of that for you so that you have good data to make those decisions? Like, your decision is who can help you make those decisions the best.

Your bookkeeper should be an industry expert. They should know what is customary

and so I think that's where I go back to the fistfight that I didn't have with the asshole on Facebook who doesn't know what really good bookkeeping is because he's just blind to what it should be like. I don't care what it was or what you think it is? It's not your. Your grandma in law, that was a bookkeeper, and then she retired, and so now she's got time to do yours. But she doesn't. She's never held a shovel running a home service business. She knows nothing about your industry or how your business works. That shouldn't be your bookkeeper. Your bookkeeper should probably not be a local person. Like, what does local knowledge do to help you run your business? Where they're going to route your jobs for you.

Now, they know the weather. Yeah, they're.

They know the weather. That's about it.

humidity.

but it's. They should be an industry expert. They should know what is customary and measure you against that, what works and what doesn't work, and how to set stuff up to measure it the right way. And so I think that's really important. That's your decision. As the business make is the business owner is who can help you the best with that. And if it's us, cool. If it's not us, that's cool, too. I'm still here to help pick my brain, whatever I can do. But I think that's what you should be looking for. You don't need to be the one doing the bookkeeping, but you need to know what's all out there and what can be the most helpful to help you scale the business profitably.

I love that. Yeah. And when you get someone like that, you can have those, educational conversations. So if you do the video and you say, well, this is where you're up, this where you're down, whatever, and then you can be like, well, why does that matter? Right? And then you can explain it. Well, from your standpoint, it might not right now, but from a financial standpoint, you're good. But eventually your cash flow is going to have a problem or whatever. Whatever this scenario is. So, yeah, I think it's our obligation as business owners. Just like, if we're going to go get certified in our industry or. Or get licensed or whatever it is, like, it's our obligation to, like, know these things. And. And if. If we're nothing, if we don't and we're not taking this stuff serious, then we're screwing ourselves over. Our team members, our families, our business. I mean, our clients. Like, we have to take this serious because it does. The crazy thing is, as much as people hate math, like, it's all solvable by math. And, like, it's really easy to identify the problems and the good things to be like, hey, this is working really well. Why don't we invest more into here? Or this isn't working. And some of it, so much of it is solvable if someone would just get a relationship with their bookkeeper.

Yep. Yep. And I, And I probably the. This is. This is as basic as if you run a home service business answering your phone like, it's this. It's the easiest thing to do, but it's actually what sets most good home service companies apart, is that they answer their phone or get back to people quickly. Bookkeeping is no different. When I take over a set of books and it's garbage, it's always because the communication from the previous bookkeeper was garbage. They were sporadic. They didn't check in very often. They didn't have a good system to communicate. We touch base with every client every single week. That's just par for the course, because if the communication is good, the bookkeeping is good by default. it's just a communication game. So I'd say if you're. If you're in the market for a bookkeeper, or if you're. As I'm saying this, you're like, what should I be looking for? My bookkeeper? To me, that's it. It's got to be weekly. They've got to be on top of it. Nobody wants to get a big list of stuff at the end of the month, and it's got to be reported to you in a way that helps you make decisions the best. Usually that would be something industry specific, reporting wise. And so if you're not getting that, I would say you're selling yourself short on what you're doing from a bookkeeping standpoint.

Dan Plata is one of the coaches inside landscape lighting secrets

Cool. Well, I've appreciated getting to know you and working with you. I don't know if I announced you as this, but Dan is also one of the coaches inside landscape lighting secrets. So you've got quite a handful of books that you do for landscape lighting, which is cool because you're able to give me feedback, and, like, with these numbers, I'm like, I don't know. This was my numbers five years ago. But you can give us, like, real time data and stuff. if someone does want to reach out to you, how do they get in touch with you? And. And when. When would be a good time is, do we wait until December? Because then, you know, that's when our books are going to be closing. Or, like, how does it work?

easiest way to find me is probably just grab me on Facebook if you're on here. You're probably mostly on Facebook anyway. Just, shoot me a message on Facebook. Dan Plata. I think I'm the only damn plot out there.

That's cool. it's hard to find Ryan Lee. There's a lot of them out there.

I bet there's a lot of Ryan Lee's. There's not many damn plottas. hit me there or go to bestdam bookkeeping. com. and the link at the top is just a link to my calendar.

Get your bookkeeping done now before October, November gets here

We'll spend an hour, like, nerding out on your business during a demo. I love, love diving into people's businesses. And frankly, the best time to do it, Ryan, is actually, like, right now, before October, November gets here. Because once October and November gets here, you're slammed and your head is down and you don't. You're just running your business and you don't have good day to do it, usually. And so if we can get it done now before you get to October, so you know what to actually be working on come October, November. That'd be the best case. it's hard to get going in October and November because everybody is so busy trying to make the last amount of money for the calendar year. So don't wait until October, November. Don't wait until the end of the year because then you're in the mad rush of everybody else, right? Everybody that procrastinated wants their books done then and then you're just in line. But if you go now, everybody else is focused on other stuff, and you can focus on getting good data so you can crush it in October and November instead of just work your ass off in October, November, and hope you make some money. So now's the time.

Love it. Let's do it. So no matter what you're going to do, even if you already have a bookkeeper, you like them, that you think they've been doing an okay job for you, reach out to them, say, hey, I want to get on a call. I want to make sure I understand these numbers. Tell me, tell me what this means. Help. Help me interpret these results so I can make decisions. And, you know, I imagine there. There's probably some good people out there that just have never been asked that. They just are stuck in the rut of like, oh, I'm a bookkeeper. I just do these things. And, there's you. You might have a chance of keeping your bookkeeper and, like, building that relationship if you're don't. If you don't have a bookkeeper, or you've just had a bad relationship, then definitely consider reaching out to Dan. this dropping my.

I'm dropping my website in the, in the notes here.

Averagedam bookkeeping. com.

That'S right.

it's best damn bookkeeping. com. so go do it. So thanks, Dan. I really appreciate you coming on here, man. That was good stuff.

You know it. You know it's my favorite.

All right, guys, thanks.

Everybody.

Go implement. Go get on a call with your bookkeeper. Make sure you know the numbers so you can make decisions and make tons of money and stuff. All right, guys, have a good weekend.

That's all I can do.

Dancing.